### 날짜 : 2024-03-25 15:29

### 주제 : Time Inconsistency and Hyperbolic Discounting #economics

----

Time inconsistency and hyperbolic discounting are concepts that explain why people's preferences can change over time, especially in ways that contradict their long-term goals or interests. These concepts are crucial in behavioral economics and help to understand why people often make decisions that are not optimal for their future selves.

### Time Inconsistency

Time inconsistency refers to the tendency of individuals to change their plans for future actions due to a shift in the perceived utility or value of those actions as the time to realize them gets closer. In other words, preferences change over time, such that what's considered the best course of action in the present may not align with what was planned for in the future.

For instance, many might plan to start a diet next month, believing that the long-term benefits outweigh the short-term pleasures of unhealthy eating. However, when next month arrives, the immediate satisfaction from tasty, calorie-rich food tends to outweigh those future benefits, and they might postpone the diet yet again.

### Hyperbolic Discounting

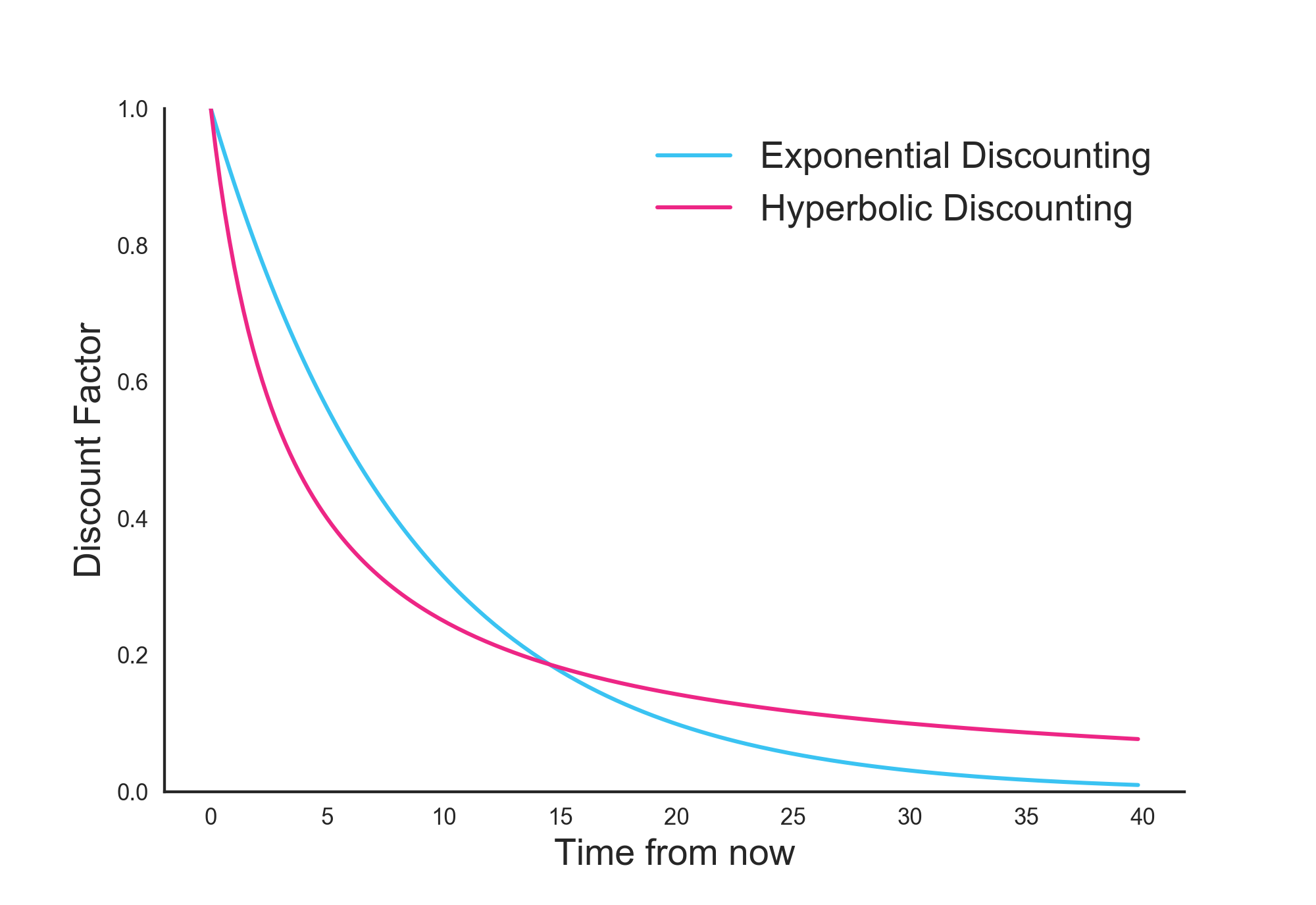

Hyperbolic discounting is one model used to explain time inconsistency. It posits that the value people place on rewards decreases more rapidly for near-term rewards than for far-off ones. Unlike exponential discounting, which assumes a consistent rate of discounting future values, hyperbolic discounting suggests that the rate of discounting changes over time.

According to hyperbolic discounting, individuals value immediate rewards much more highly than future rewards. The present bias means that as a reward gets pushed further into the future, its perceived value starts to decrease at a slower rate.

### Implications

The tendency towards time inconsistency and hyperbolic discounting has several implications:

- **Saving Behavior**: People tend to struggle with saving for the future, often preferring to consume now rather than to save and consume more later.

- **Health Choices**: Decisions involving long-term health benefits, like quitting smoking or regular exercise, are often procrastinated.

- **Addiction**: Time inconsistency can explain why overcoming addictions is so hard. Even if individuals genuinely want to quit, the immediate gratification of the substance can, at any given moment, be valued more than the long-term benefit of quitting.

- **Debt and Credit Use**: Consumers may overuse credit for immediate purchases, underestimating the negative impact of future debt.

### Mathematical Representation

In mathematical terms, hyperbolic discounting can be represented by a specific formula for the present value of a future reward:

\[

PV = \frac{U}{1 + kD}

\]

where \(PV\) is the present value of the reward, \(U\) is the utility of the reward, \(D\) is the delay in receiving the reward, and \(k\) is a measure of the individual's rate of time preference. This differs from classical compound interest, which would use an exponential function for discounting.

### Strategies to Mitigate Time Inconsistency and Hyperbolic Discounting

Several strategies have been developed to help people make more consistent decisions over time:

- **Commitment Devices**: People can bind themselves to future actions through contracts or penalties. For example, making a non-refundable payment for a year's gym membership motivates attendance.

- **Pre-commitment**: Deciding in advance and setting up automatic decision processes—like automatic transfers to a savings account—can help support long-term goals.

### Conclusion

Time inconsistency and hyperbolic discounting capture the reality of human decision-making much better than the rational models that assume consistent discounting over time. They explain a wide range of behaviors that might seem irrational in terms of classic economic theories but are accurately reflective of real human behavior. Understanding these concepts is critical for designing economic models, policies, and products that better fit human tendencies and can help individuals achieve longer-term objectives.