### 날짜 : 2024-03-25 14:55

### 주제 : Prospect Theory #economics

----

# Prospect Theory

Prospect Theory is a behavioral economic theory that describes the way people choose between probabilistic alternatives that involve risk, where the probabilities of outcomes are known. The theory was formulated by psychologists Daniel Kahneman and Amos Tversky in 1979 and is considered a cornerstone of behavioral economics.

### Key Aspects of Prospect Theory

Prospect Theory can be broken down into several key components:

#### 1. Value Function:

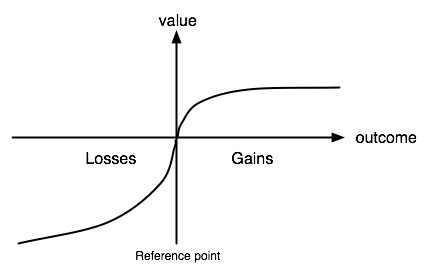

Prospect Theory introduces a value function that is defined over changes in wealth or welfare, rather than final states of wealth or welfare. This function has several important properties:

- **Reference Dependence**: The value function takes into account gains and losses relative to a reference point (status quo or expectations), instead of considering the final wealth.

- **Loss Aversion**: This function is typically steeper for losses than for gains, illustrating that losses usually have a greater emotional impact on individuals than an equivalent amount of gains (losses hurt more than gains feel good).

- **Diminishing Sensitivity**: The function is concave for gains and convex for losses, indicating diminishing sensitivity. This means that the difference between $100 and $200 is more significant than between $1100 and $1200 (diminishing marginal utility).

#### 2. Probability Weighting Function:

- People tend to overweight small probabilities and underweight large probabilities, which means they overreact to small chances of a significant gain or loss (buying lottery tickets or overly insuring against small risks) and underreact to large probabilities.

- This part of the theory deviates from expected utility theory, where it is conventionally assumed that people evaluate risk in accordance with the actual probabilities of outcomes.

#### 3. Framing Effects:

- The way that choices are framed can significantly affect the decisions people make. People tend to be risk-averse when a choice is presented as a gain (preferring a sure gain over a gamble with higher expected value) and risk-seeking when a choice is presented as a loss (preferring to gamble to avoid a sure loss).

### Prospects and Loss Aversion

One key insight of Prospect Theory is loss aversion. For example, consider a situation where an individual is given two choices:

1. A sure gain of $50

2. A 50% chance to gain $100 and a 50% chance to gain nothing

Though the expected value of the two options is the same, most people will choose the sure gain of $50, demonstrating risk aversion in gains.

Conversely, if individuals are presented with:

1. A sure loss of $50

2. A 50% chance to lose $100 and a 50% chance to lose nothing

In this case, many individuals would choose the riskier option, hoping to avoid the loss, demonstrating risk-seeking behavior in the domain of losses.

### Applications of Prospect Theory

Prospect Theory has been applied in numerous fields to describe and predict behavior under risk:

- **Economics and Finance**: Explaining market anomalies, investor behavior, insurance purchasing, and risk-taking.

- **Public Policy**: Designing policies and understanding public response to policy risks, such as environmental and health risks.

- **Marketing**: Pricing, promotions, and how consumers make buying decisions under uncertainty.

- **Medicine**: How patients make choices about treatments involving risks and uncertainties.

### Critiques and Developments

While Prospect Theory has been highly influential, it is not without its critiques. Some critics argue that it lacks a prescriptive power or a firmly axiomatic base, unlike expected utility theory. Others have pointed out situations where people's behavior doesn't align with the predictions of Prospect Theory.

Nonetheless, Kahneman's pioneering work on Prospect Theory contributed to his Nobel Prize in Economics in 2002, recognizing the extensive implications the theory has had on economic science and our understanding of decision-making under risk.